Income Tailwinds

Attractive industry & market tailwinds, with growing addressable market

Target Distribution Return

(Annualised target yield, net of fees and expenses & before adjustments for FX rate fluctuations.)

Unit Price (as at 28/02/2025)

Class A Inception Date

The US middle market is benefiting from the biggest investment tailwinds of the coming decades. This includes re-shoring of jobs and manufacturing to middle-America and the AUD$500+bn pledged by the US Government to support decarbonisation.

For the very first time, Australian investors can access this asset class through a strategy carefully curated by our product partners, Morgan Stanley.

The US Private Credit Fund indirectly invests into a defensive portfolio comprising a majority of directly originated senior secured loans issued to US middle market companies.

Note: This offer is exclusively for Wholesale investors.

Attractive industry & market tailwinds, with growing addressable market

Directly negotiated senior debt, majority or predominantly PE sponsored.

Important information : This offer is for wholesale investors in Australia only. For the avoidance of doubt, these products are not intended to be sold to US Persons as defined under Regulation S of the US federal securities laws.

~ While the Responsible Entity intends to do this on a best endeavours basis, the Fund may not provide complete protection from adverse currency movements.

* This target yield is not a forecast, projection or prediction of the performance of the Fund. The Fund’s target yield is not and should not be seen as a statement about the Fund’s likely future performance and there is no guarantee that the performance of the Fund will achieve the target yield. The target distribution return is net of fees and costs but excludes any adjustments for FX rate fluctuations. The target return is reviewed monthly and may change. This is a target return only and may not be achieved.

# Redemption requests are generally processed on a quarterly basis in accordance with the Information Memorandum. Investors do not have a right to redeem and the Responsible Entity (RE) may reject redemption requests. The ability to redeem is subject to liquidity and the processing of redemptions may be delayed or suspended in certain circumstances. The RE will limit redemptions to up to 5% of the issued Class A Units each quarter. Redemption requests exceeding that limit may be accepted by the RE, pro-rated or scaled back to 5%. Please refer to the Information Memorandum for more details about redeeming Class A Units and how to submit a redemption request form.

As at 28 February, 2025.

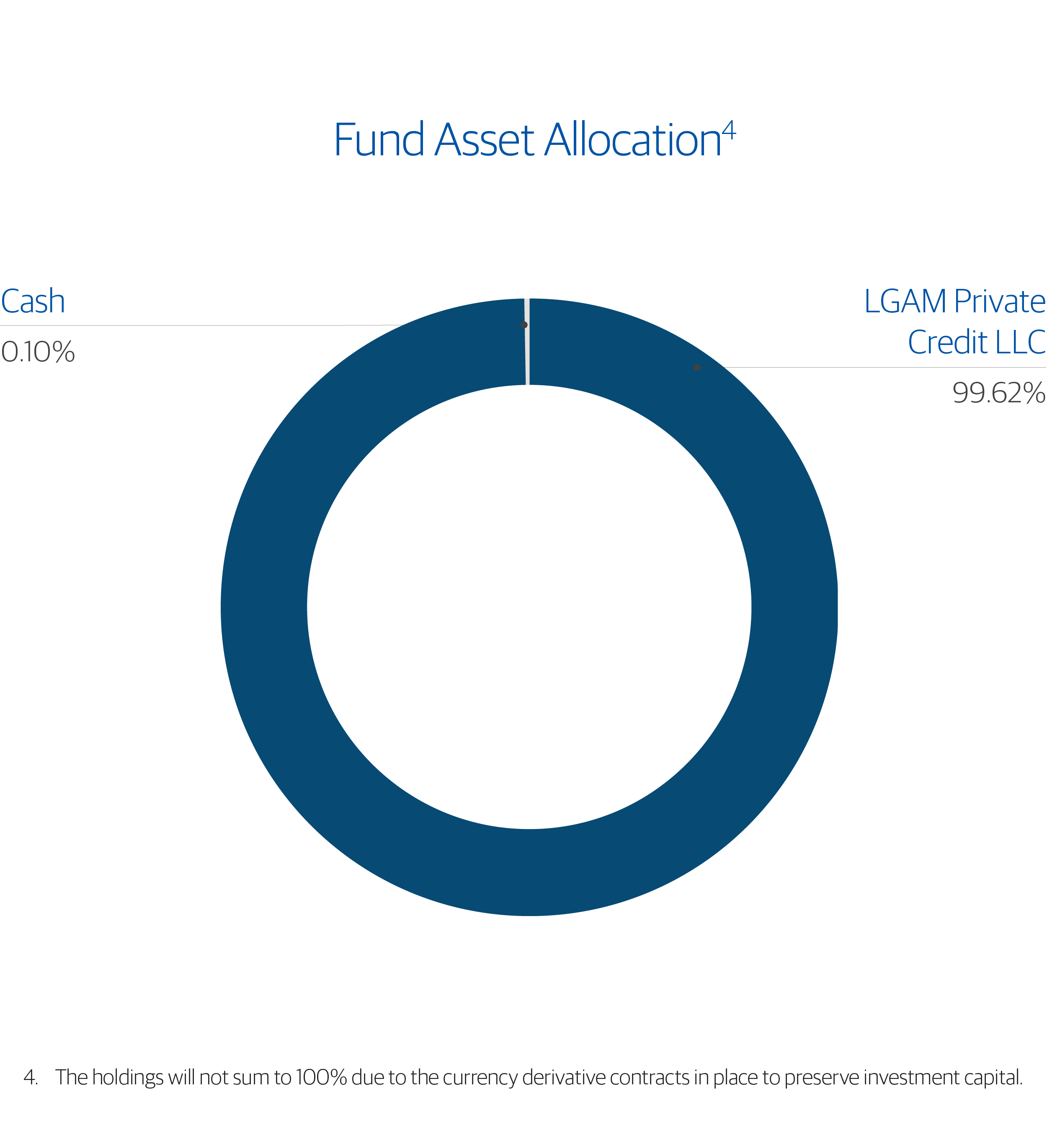

7As of 31 January, 2025, based on fair market value. No guarantee can be given that the Fund will be able to identify similar or comparable investment opportunities, or have the same overall composition as shown above, in future periods. The Fund’s portfolio composition is subject to change any time without notice as permitted by the Fund’s offering and governing documents, as may be supplemented and amended. Figures shown are unaudited and are rounded and therefore totals may not sum.

View the latest Fund Profile

Download the Information Memorandum for Class A Units

Complete the investor application form

Scan and email your application form to our investor team.

We are always here to help. Talk to our friendly Asset Management team – 1800 818 898

~ While the Responsible Entity intends to do this on a best endeavours basis, the Fund may not provide complete protection from adverse currency movements.

* This target yield is not a forecast, projection or prediction of the performance of the Fund. The Fund’s target yield is not and should not be seen as a statement about the Fund’s likely future performance and there is no guarantee that the performance of the Fund will achieve the target yield. The target distribution return is net of fees and costs but excludes any adjustments for FX rate fluctuations. The target return is reviewed monthly and may change. This is a target return only and may not be achieved.

# Redemption requests are generally processed on a quarterly basis in accordance with the IM. Investors do not have a right to redeem and the Responsible Entity (RE) may reject redemption requests. The ability to redeem is subject to liquidity and the processing of redemptions may be delayed or suspended in certain circumstances. The RE will limit redemptions to up to 5% of the issued Class A Units each quarter. Redemption requests exceeding that limit may be accepted by the RE, pro-rated or scaled back to 5%. Please refer to the IM for more details about redeeming Class A Units and how to submit a redemption request form.