“Predicting rain doesn’t count: building the ark does.” This simple and lesser-known quote of Warren Buffett speaks to many of the investment themes La Trobe Financial has espoused across a generation. We know that every decade will throw up one or more economic crises. We know that there’s always another one around the corner. So, build an ark – build portfolios that perform at all points along the economic cycle.

At La Trobe Financial, our foundational portfolio products have each delivered impeccable performance at all points across the economic cycle. Through the GFC, COVID and everything in between, our portfolio offerings have delivered:

- No losses for investors;

- Each monthly distribution paid at the advertised rate; and

- All scheduled maturity redemptions paid on time, and in full.

For investors, that is an ark. Whatever the economic storm, a La Trobe Financial portfolio investment has produced exactly the outcome it was designed to do.

This delivery of quality is based on some very simple fundamentals: Quality assets, quality & transparent structures, and experienced management. Sounds simple!

Consider our 12 Month Term Account. A granular portfolio of over 9,000 high quality assets, diversified by sector, diversified by location, and diversified by borrower type. The 12 Month Term Account operates with an easy to understand structure, and our publicly available monthly portfolio reporting is among the most transparent and comprehensive in the industry. And of course, we have decades of experience in managing assets across all market conditions.

Introducing La Trobe Global Asset Management

In December 2023, La Trobe Financial launched its inaugural strategy under the La Trobe Global Asset Management series. Our La Trobe US Private Credit Fund harnesses the best attributes of US Middle Market companies to deliver a defensive, low-volatility yield for Australian investors.

With the impending launch of the retail investor class offering, with the Product Disclosure Statement (PDS) available on or around 14 June 2024, it is timely to introduce the strategy, and how it, too, can form an ark for investor portfolios.

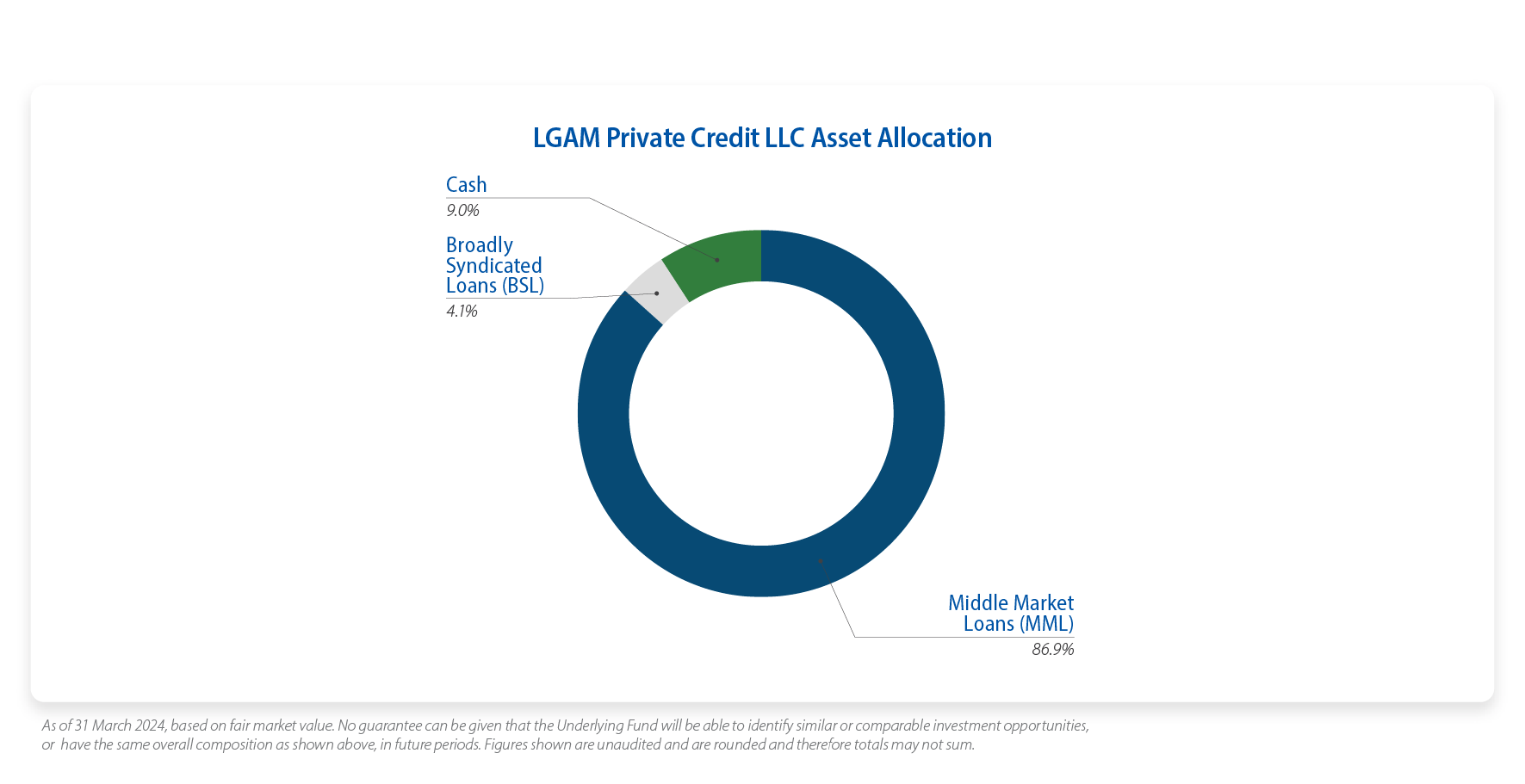

Starting with assets. The strategy invests into a diversified portfolio of assets. These are predominantly senior secured, directly originated loans to companies in the US Middle Market. The La Trobe US Private Credit Fund indirectly (via the LGAM private Credit LLC (Underlying Fund)) targets high quality companies of scale with annual EBITDA of US$25m-$200m. These are companies with high barriers to entry and resilient repeatable free-cash flow, led by deeply experienced management teams.

A senior secured loan means that we get paid our income first, and when the loan is repaid, we get our capital paid first. Being at the top of the capital stack is one of the keys to ensuring that investors, too, enjoy low volatility of capital.

Our strategy of indirectly investing in a holding of quality assets, with a minor allocation to cash and liquid assets, delivers a portfolio achieving risk-adjusted returns and periodic liquidity opportunities for investors.

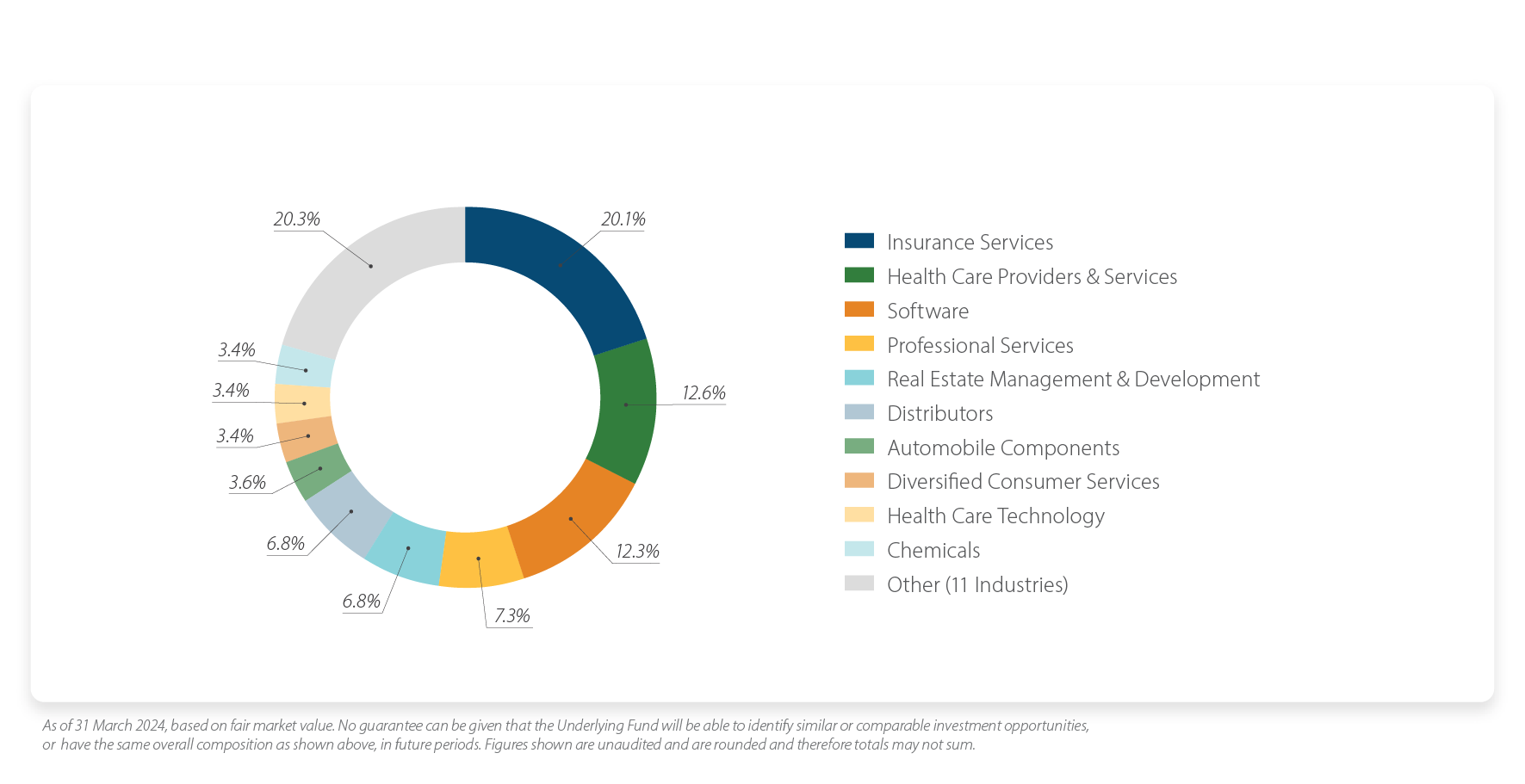

To deliver a more predictable income experience, the strategy avoids lending to businesses in cyclical industries. Avoiding loans in tourism, hospitality, retail, and other sectors which tend to deliver a more cyclical income profile. These kinds of investment guardrails ensure that industries more likely to experience volatility simply cannot take a position within our portfolios. No one sector will drive the performance up – or down – as markets inevitably shift over time.

After excluding cyclical industries, it then comes down to diversification across other sectors. Creating a wide-ranging sectoral exposure is key to delivering a low-volatility income and capital experience for investors.

Underlying Fund – Industry Allocation

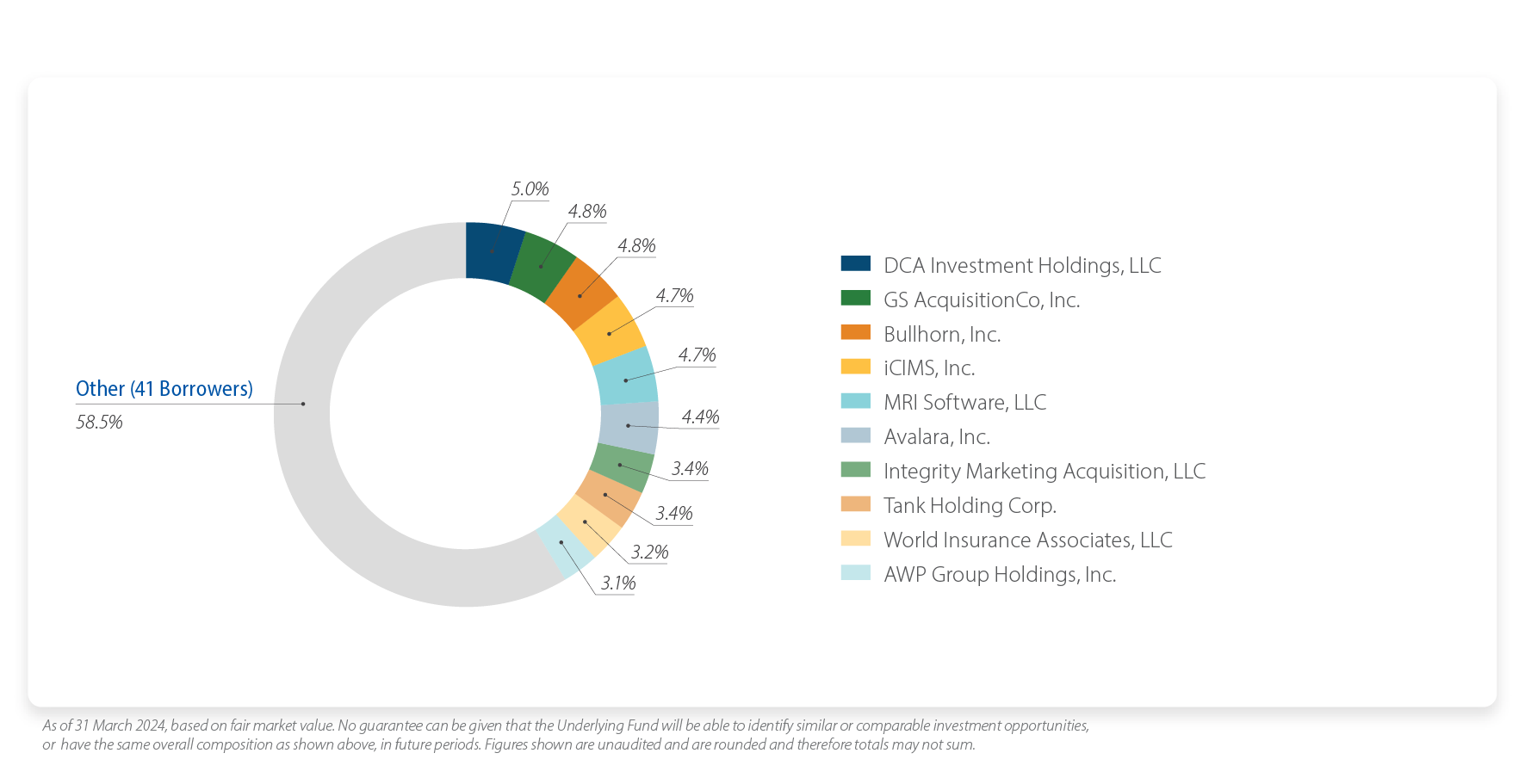

Finally, it’s important that all your eggs aren’t in the same basket. So, with a portfolio populated by first lien loans, avoiding cyclical industries, and with diversified industry exposures, the next layer of consideration is at borrower level. That’s another key to building an ark. The La Trobe US Private Credit Fund indirectly holds exposures across a wide range of borrowers, ensuring the performance of any single borrower cannot adversely drive outcomes for investors.

Underlying Fund – Borrower Diversification

The c100,000 investors^ of La Trobe Financial’s existing products have enjoyed the ark we have built. Quality assets, quality structures, and our experience as a manager. Investors in our La Trobe US Private Credit Fund can likewise rely on management experience through our partnership with Morgan Stanley. As the strategy’s asset originator, Morgan Stanley’s US Private Credit team represents the world’s leading participant in US middle market lending, ensuring our strategy will continue participating in the highest quality assets available in the market.

Opportunity for investors

La Trobe US Private Credit Fund

Institutional investors – and more recently wholesale investors – have been using US Private Credit to build their arks for decades. At La Trobe Financial, we are now delivering that same opportunity for Australian retail investors. With our Product Disclosure Statement and Target Market Determination coming on or around 14 June 2024, we welcome any queries by contacting our Asset Management Team on 1800 818 818.

# The offer to apply for Class A Units in the La Trobe US Private Credit Trust is open to wholesale investors only. Investors applying to invest less than $500,000 will need to produce an accountant’s certificate to support their wholesale status. For more information, please refer to the Application Form (Annexure 2 to the Information Memorandum).

+ A description of the target market for La Trobe Financial’s US Private Credit Fund – Class B Retail Units can be located on our website.

La Trobe Financial Asset Management Limited ACN 007 332 363 Australian Financial Services Licence 222213 is the responsible entity of the La Trobe Australian Credit Fund ARSN 088 178 321 and the La Trobe US Private Credit Fund ARSN 677 174 382. It is important for you to consider the relevant Product Disclosure Statement (PDS) for a fund in deciding whether to invest, or to continue to invest, in a fund. You can read the PDS and the Target Market Determinations for the La Trobe Australian Credit Fund on our website. The PDS for the US Private Credit Fund will be available on our website on or around 11 June 2024.

Past performance is not a reliable indicator of future performance.

To the extent that any statement in this email constitutes financial product advice, that advice is general advice only and has been prepared without considering your objectives, financial situation or needs.

© Copyright 2024 La Trobe Financial Services Pty Limited ACN 006 479 527. All rights reserved. No portion of this may be reproduced, copied, or in any way reused without written permission from La Trobe Financial.