With inflation coming back under control, and the beginning of interest rate cutting cycles across some developed economies, the final months of 2024 saw some semblance of certainty. After all, markets love certainty. Over in the US we saw stock markets surging. Here in Australia the ASX200 hit a series of all-time highs across the calendar year. From the ‘perma-crisis’ of the COVID era, this was a welcome change.

But the more things change, the more they stay the same.

We look into 2025 with market forecasts of positive economic growth and a slowdown in the rate of inflation. And now, we have seen the beginning of a rate cutting cycle in Australia.

You might say, you can take these forecasts with certainty. But none of us have a crystal ball, and an array of headwinds and tailwinds will drive outcomes. For investors, it’s always worth remembering that even if you hope for the best, it’s best to prepare for the worst. What does that mean? It means to diversify your portfolios with quality assets, in quality structures, delivered by quality managers.

The following represent key economic headwinds, and tailwinds to be navigated through 2025.

Headwind 1 – Geopolitical uncertainty

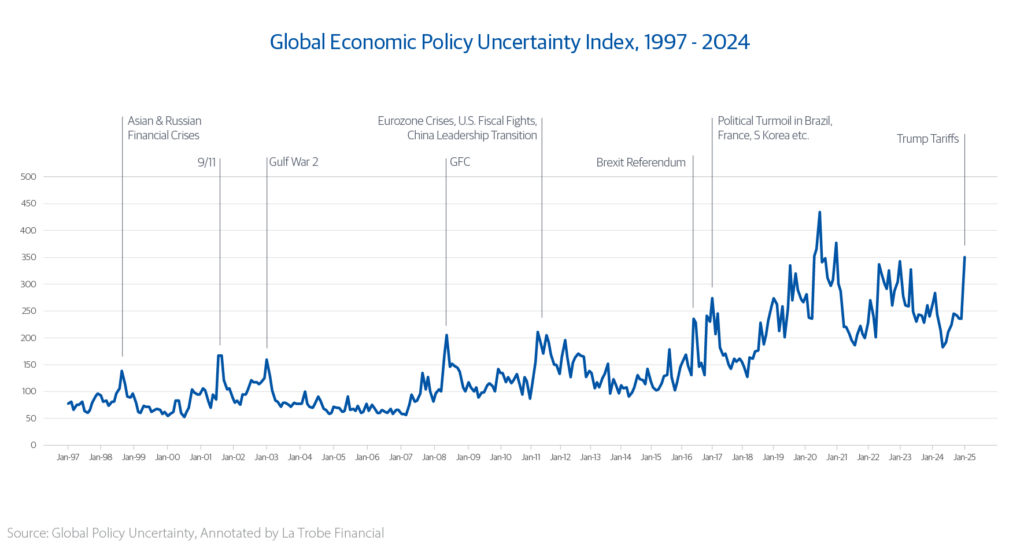

It should be no surprise that geopolitics are a big risk for economic outcomes in 2025. We still have a war in Ukraine. We still have a fractured Middle East. We still have unease across the South China Sea.And most recently, we have a Trump presidency moving in, and out, of political positions at a moment’s notice.

Remembering how quickly inflation jumped after Russia invaded Ukraine serves as a reminder that global politics can shift on a dime, causing far-reaching impacts. Markets do crave certainty, and this is the opposite. With uncertainty running hot, this is one to watch.

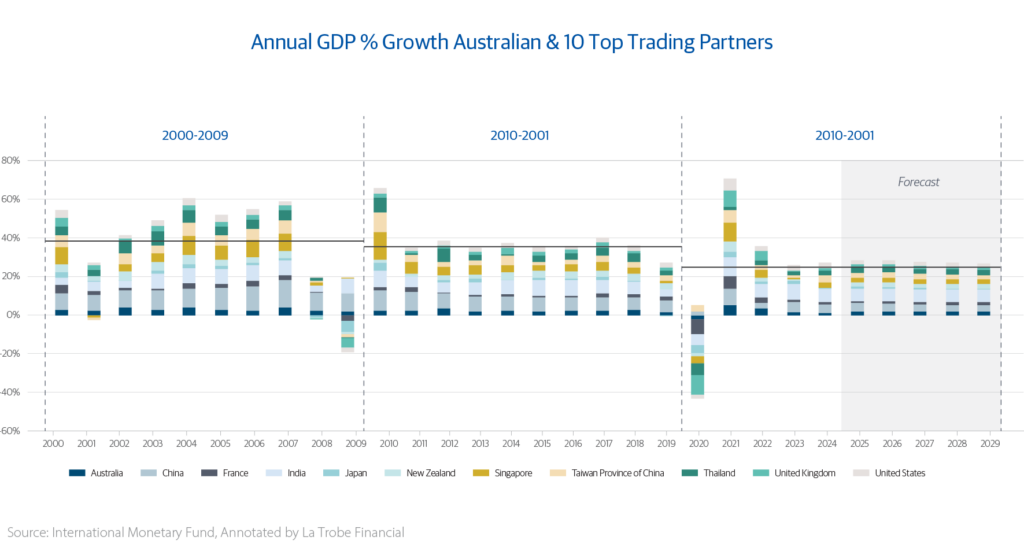

Headwind 2 – Our Partners of Growth… not growing as much

As a nation built on trade, for a long while now we have been asking where the next round of growth will come from. Consider the annual GDP growth of each of our top 10 trading partners, in aggregate, across a three-decade period. What we see is a distinct step-down each decade. If our trading partners aren’t growing by as much, how can we?

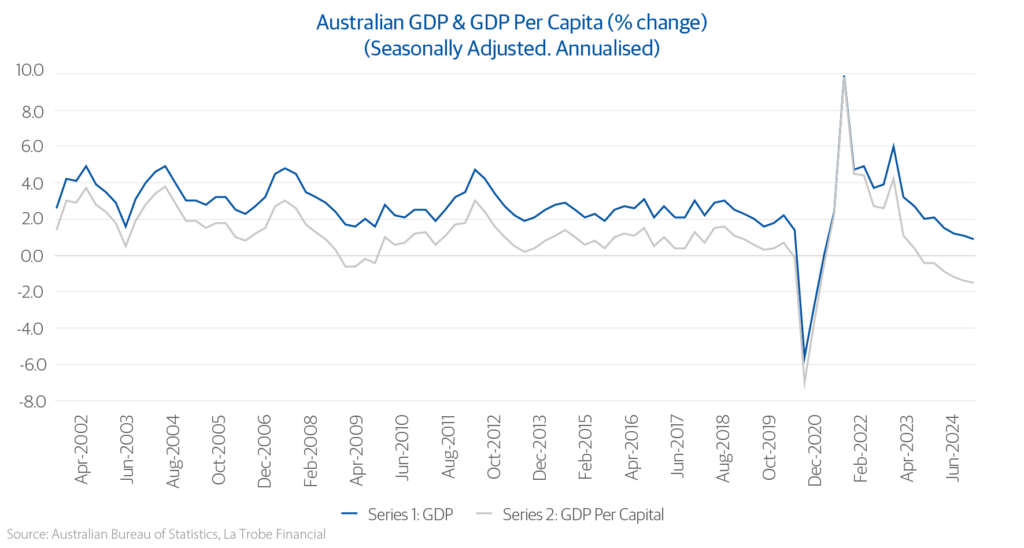

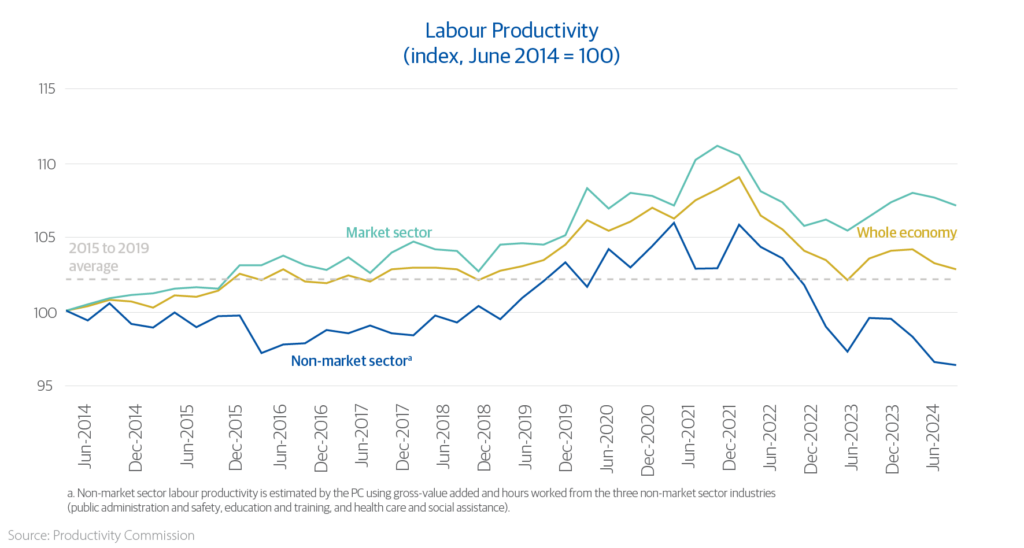

The third callout is economic growth per capita and Australia’s declining productivity.

While our economic growth is positive – just – this papers over eight of the last nine quarters in negative GDP per capita. This means that as a country, our economic output is falling against the number of people in it. In other words, we’re not being productive enough.

There are a range of arguments as to why, and it’s not quite as simple as blaming the public sector. The range of policy responses to the pandemic prioritised full employment at all costs, and productivity paid the price. Likewise, Australia’s Productivity Commission’s most recent annual report showed productivity had decreased year-on-year in 11 out of 16 measured industries¹.

Productivity growth is the main driver of long-term income growth and standards of living. Doing more with less is likely to be a mantra going .

Now to the good news. There are a range of economic tailwinds which will support or drive our economic performance in the year ahead.

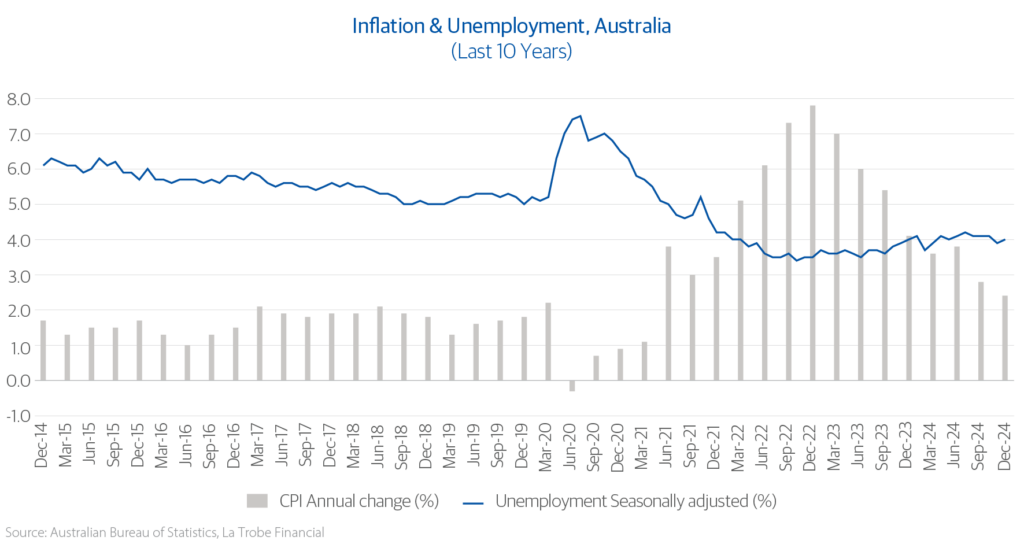

The ultra-low interest rate settings through the pandemic, together with the growth in government spending, were aimed at keeping Australians employed. So it’s no surprise unemployment has stayed low. Notwithstanding the impact on productivity, this is still a great starting point for any discussion around the economy, noting the benefits of a fully employed population.

Australia finds itself in the enviable position of seeing the recent inflationary cycle recede without a meaningful jump in unemployment. With inflation descending , and a fully employed population, Australia is as well positioned as it could be to push ahead into the back half of the decade.

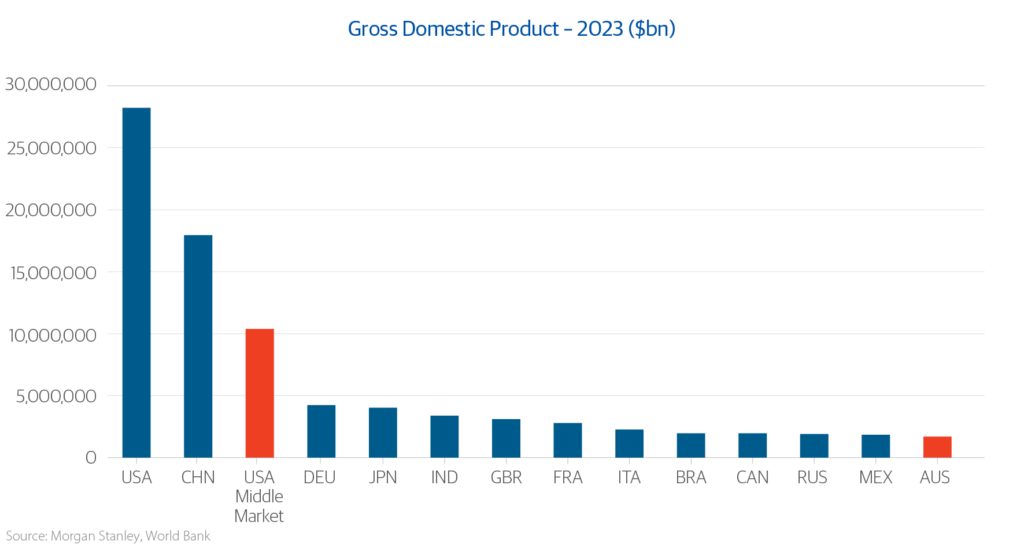

In a study of contrasts, the U.S. business community got what it wanted with a market-friendly Donald Trump, talking up tax cuts. Optimism is high across businesses, in the largest economy in the world. Just taking the US middle market companies in isolation, a segment representing 40% of US GDP (and in its own right the third largest economy in the world) there are strong tailwinds through growth in manufacturing and onshoring of supply chains. A market much larger than Australia in 13th position.

As a rising tide lifts all boats, we expect a dynamic business community, growth in productivity and growth from the U.S, which we count among our top 10 trading partners.

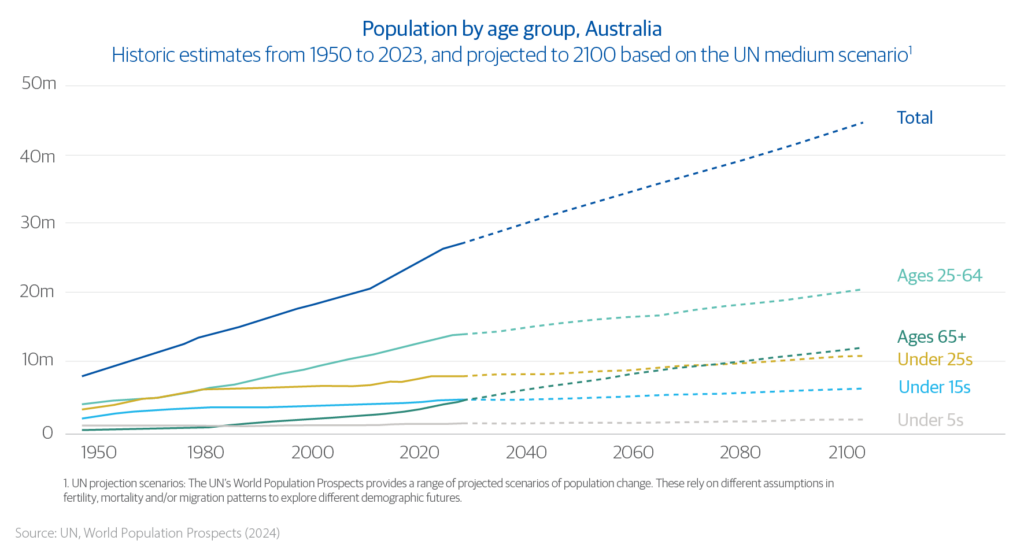

This is more of a longer-run item, but the old adage of ‘demographics are our destiny’ is yet to be disproven. And while there is a lot of pushback on population and the effect on housing, there is no mistaking that our immigration policy stepped in at a time of falling natural population growth.

Not all countries enjoy this position. There will be challenges with an aging population, but ours are not so great they can’t be addressed. Our population demographics broadly aligns with the U.S, and remains in good shape.

On that note, consider the plight of China, which is facing into a period marked by an aging population in overall decline. These challenges will need to addressed structurally with uplifts in tech and productivity. If anyone can do it, China can. And any efforts on tech, services and productivity ultimately deliver net benefits for Australia.

Invest for tomorrow, today

Each year provides a new set of headwinds, and a new set of tailwinds. But getting rich slowly never goes out of fashion.

For investor’s it’s simple.

Keep it simple: Understand what you’re investing in. Any investment opportunity that is overly complex, or sounds too good to be true, should be a huge red flag.

Diversify: With all the headwinds, tailwinds and unknowns we face into, it makes sense to diversify. Consider if you have a wide selection of quality investments to steer your wealth at all times along the economic cycle.

Be patient: It can be tempting to try and increase the pace of your wealth generation. But it’s rarely achievable without taking on additional risk. So consider your goals and whether a proposed investment is in line with your risk appetite.

At La Trobe Financial, we remain dedicated to providing products which deliver income and low volatility at all points along the economic cycle. Our friendly Asset Management team is available to discuss on 1800 818 818.

La Trobe Financial Asset Management Limited ACN 007 332 363 Australian Financial Services Licence No. 222213 is the responsible entity of the La Trobe Australian Credit Fund ARSN 088 178 321 and the La Trobe US Private Credit Fund ARSN 677 174 382.

¹https://www.pc.gov.au/ongoing/productivity-insights/bulletins/bulletin-2024#media-release