The four objectives of Trump’s policies

Let us note first that the Trump Presidency is doing “what it says on the tin.” President Trump has been a long-time advocate for tariffs. The US population knew that when they voted for him, and they are unequivocally getting what they voted for. Remember that when you read speculation that he might suddenly shift his policy settings.

So, what is he hoping to achieve? We can see at least four objectives in his speeches over the years.

First, and perhaps most pragmatically, he is looking to raise revenue to pay for tax breaks. Some reports state that his objective is zero income tax for anyone making less than US$150,000. The money to fund that needs to come from somewhere.

Secondly, he is seeking to rebalance global trade. Rightly or wrongly, he believes that the US has been on the wrong end of global trade deals and has suffered as a consequence. He has a particular focus on the effects of globalisation on the US middle class. He believes that tariffs will result in more jobs and opportunity for middle America.

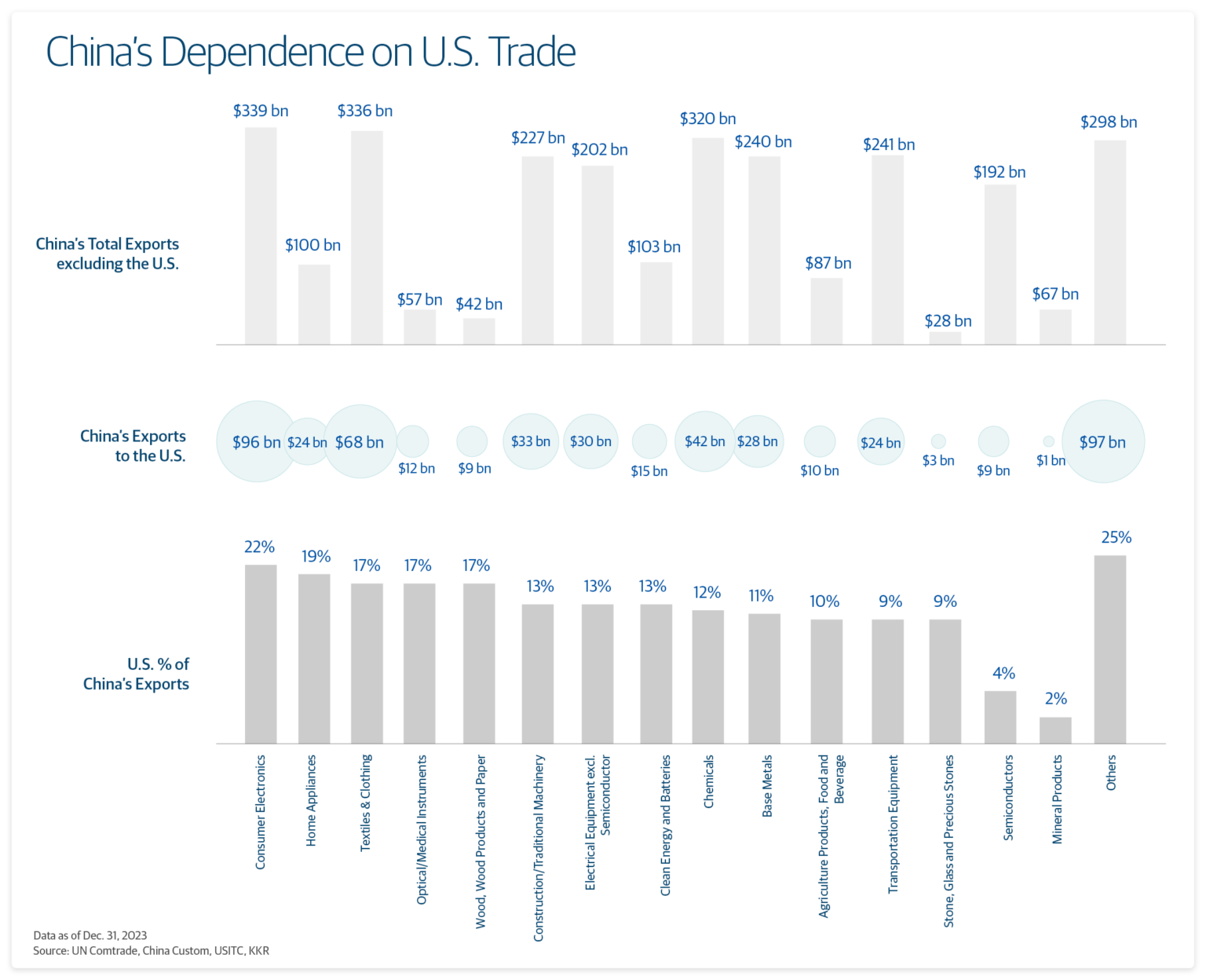

Thirdly, he is continuing the policy of strategic competition with China that has animated US foreign policy since the latter years of the Obama Presidency. China has a huge dependence on its manufacturing sector and the US is China’s dominant export destination. Restricting access to that market is likely to have a serious effect on China’s economy.

Finally, he views tariffs as one part of a program to entrench significant cultural change in the US. This is the “Wall Street vs Main Street” dynamic that motivates his voter base.

What will happen next?

Anyone who says they know what will happen is, at best, misguided. There is deep uncertainty about the policy settings that we will end up with, let alone the second & third order impacts that will flow from those policies. The situation is testing the ability of economists and central banks to forecast.

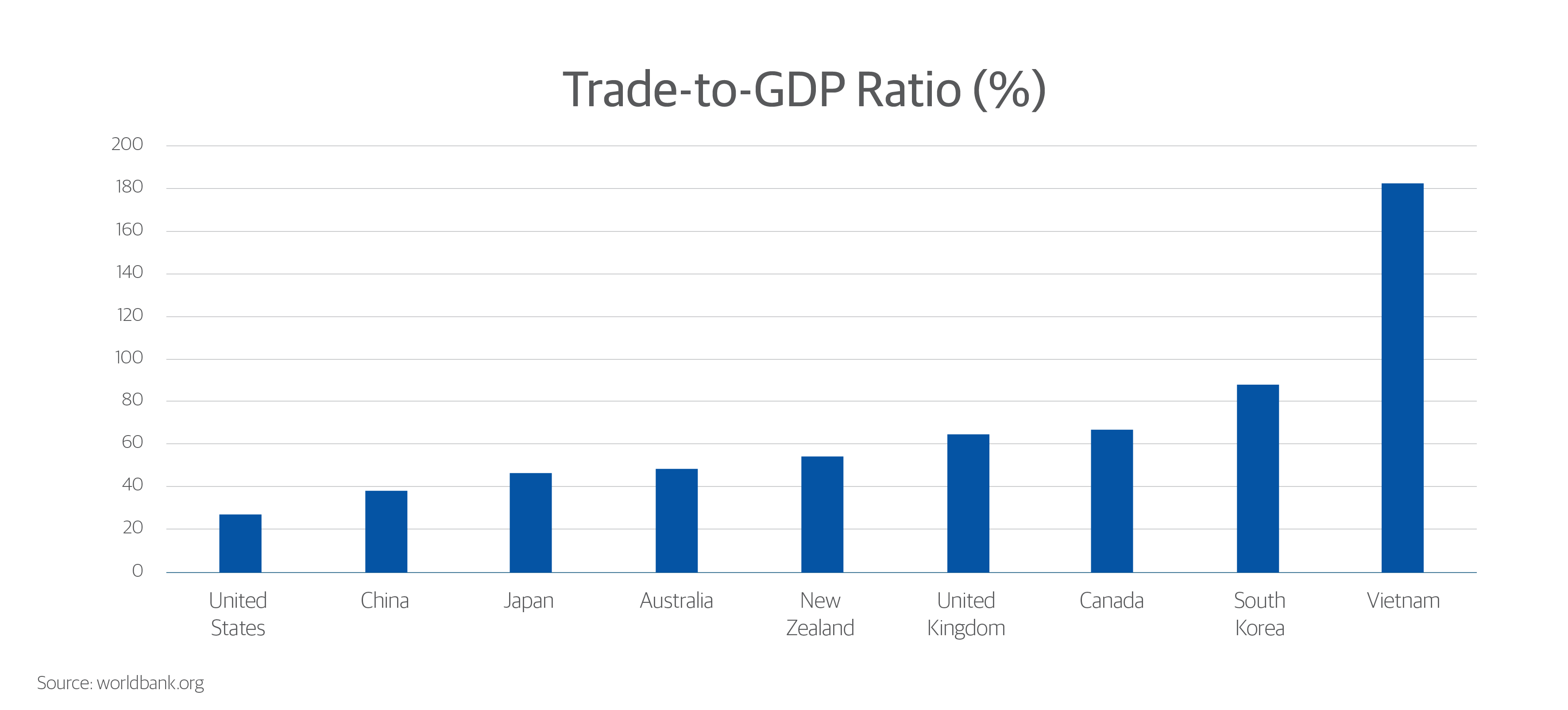

Make no mistake, the US can withstand a deglobalized world better than anyone. Their domestic economy is a titanic force and is much less trade exposed than almost any other developed nation.

But that does not mean that the tariffs will be painless for US consumers. Prices will be higher. And it is unclear how much price inflation the US consumer will be willing to bear – especially after a long five years of inflationary pressures which just looked to be easing.

In particular, it is by no means certain that the US can replace China’s role in their economy in any reasonable period. Many in the US fear that they lack the technical capability and the human capacity to substitute for the incredible manufacturing engine and supply chain ecosystem that China has built. The US offshored their manufacturing skills in the 1990s and, with employment near full capacity (4.2% in their most recent unemployment print), do not have the workers to spare to step into the new jobs that they are seeking to create. Could these policies create a new round of COVID-like supply shortages? With US mid-term elections in November next year, this question will take increasing urgency in the minds of lawmakers.

Globally, any move to reduced international trade will have a serious impact on wealth creation. Unfortunately, those impacts will be felt amongst those who can least afford it. This could damage the reputation of the US as a reliable partner and open the door for say, China or Russia, to expand their global influence. What is more, given the US economy’s capacity constraints, if one objective is to readjust global manufacturing materially away from China, they will need reliable partners across the world to step into that gap. Imposing universal tariffs will not assist that aim.

At a macro-economic level, the world is going to see the unusual combination of inflationary pressures (from higher prices) combined with lower economic activity as businesses pause or slow down investment and spending. It is entirely unclear how those factors will balance or how long they will persist. In the worst-case scenario, some economists have raised the prospect of ‘stagflation,’ a phenomenon last seen during the 1970s following the OPEC oil price shock.

What should investors do?

In considering how investors should react to all this noise, we always return to our own, long-term investment philosophy. That philosophy is based on the fundamental premise that investment, always and everywhere, means managing uncertainty.

We do not hold ourselves out as having special knowledge as to how President Trump’s policies will land. We do not believe that it’s possible to calculate the second, third and fourth order effects that will flow from them.

But we do believe that, with attention to some fundamental principles of investment, investors can build portfolios that are resilient to these and other market crises.

- Never put all your eggs into one basket: The first principle is to stay diversified. Remember that diversification is the best tool for dealing with market uncertainty and is the one true free lunch in investment.

- Keep it simple, silly: The second principle is to avoid opaque or highly structured investments that you cannot properly assess. As Warren Buffett famously said “investing is not like Olympic diving. There are no bonus points for degree of difficulty.”

- Don’t be greedy: So many investment disasters occur when investors stretch for unrealistic returns. Remember that getting rich slowly never goes out of fashion.

La Trobe Financial

As our long-term investors will be aware, at La Trobe Financial we construct our portfolios especially for times such as these. In easy markets, all managers will appear to be performing well, and investment returns accrue easily. Frequently, it’s only when the market tides turn that we can see who is swimming naked. And that’s where our long-term disciplines around asset quality and liquidity management come to the fore.

Taking our offerings in turn:

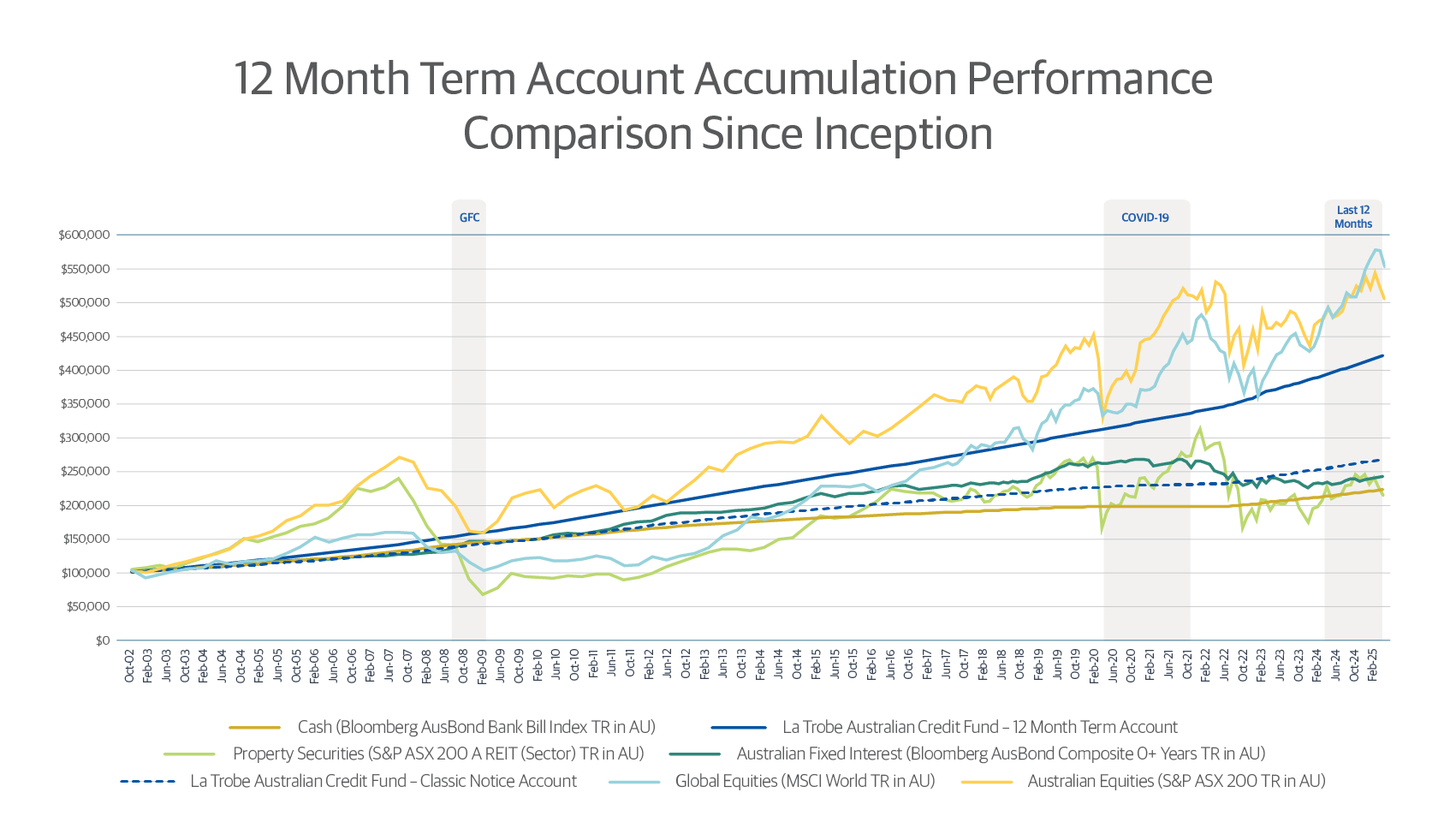

- We have constructed our La Trobe Australian Credit Fund around incredibly diversified portfolios of high-quality, low-LVR, first registered mortgage-secured loans. Our 12 Month Term Account, for example, has performed incredibly well for investors since its inception in 2002 – a period that has included the Global Financial Crisis, COVID-19 and Silicon Valley Bank. It has delivered consistent monthly income, full return of capital and flawless liquidity in each of the 270 months (and counting!) in which it has operated.

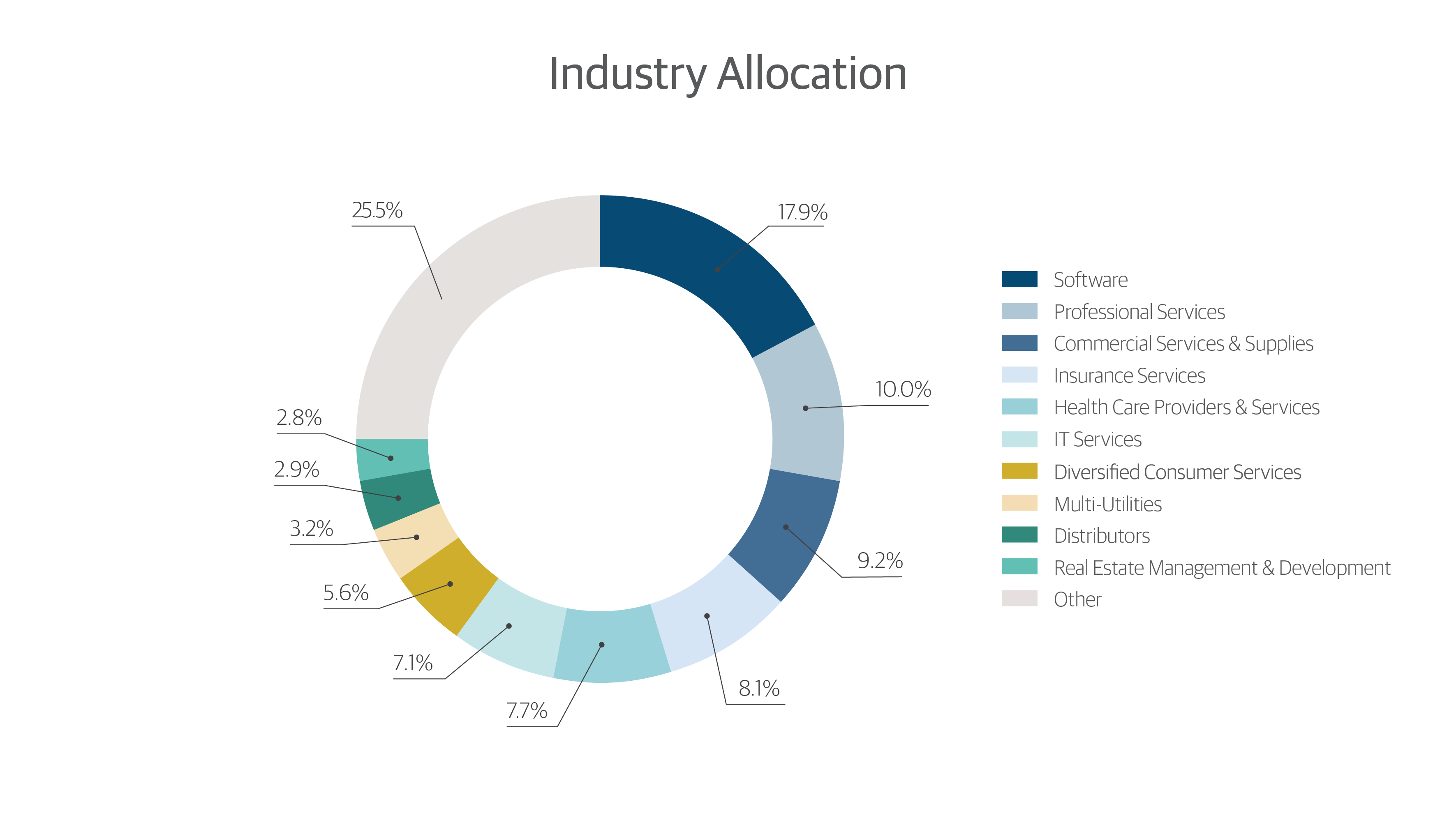

- We also built our US Private Credit strategy for days such as these. Whether President Trump’s tariffs remain in force, or are progressively bargained away, the intent of the policy is clear and is bipartisan. The US is 100% committed to the rebuilding of its middle class and of middle America. The primary driver of that rebuild, with the full-throated support of both parties through every available lever, will be the US mid-market. The thematic is baked in and only getting stronger. An appropriately conservative exposure to this via high-quality investment partners (in this case, La Trobe Financial and Morgan Stanley) can be a powerful way for investors to benefit from this mega trend. A portfolio of directly originated, first-lien senior secured loans to U.S. middle market companies operating in non-cyclical industries. A deliberately conservative strategy designed to perform through all market and economic cycles.

You can expect to hear from us regularly in coming months as the economic news continues to evolve. We would be delighted if you would join us at one of our regular webinars, in which our Chief Investment Officer, Chris Paton, will be discussing tariffs, trade and the effects on our portfolios. Details of our next webinar will be circulated shortly.

In the meantime, should you have any questions about your investment, you can see our monthly portfolio reporting here* and you should always feel free to call your friendly asset management team on 1800 818 818.

La Trobe Financial Asset Management Limited ACN 007 332 363 Australian Financial Services Licence No. 222213 is the responsible entity of the La Trobe Australian Credit Fund ARSN 088 178 321 and the La Trobe US Private Credit Fund ARSN 677 174 382. It is important that you consider the relevant Product Disclosure Statement (PDS) before deciding whether to invest or continue to invest in the fund. The PDSs and Target Market Determinations are available on our website.

*As of 31 March 2025, based on fair market value. No guarantee can be given that the Underlying Fund will be able to identify similar or comparable investment opportunities, or have the same overall composition as shown above, in future periods. Figures shown are unaudited and are rounded and therefore totals may not sum.