Each year, U.S central bankers, economists and global policy makers gather for a symposium in Jackson Hole, Wyoming. The agenda typically sets the direction across a range of fiscal and monetary outcomes for the year ahead.

At this year’s meeting, U.S Fed Chair Jerome Powell delivered a keynote speech where he made the following core observations:

- the worst of the pandemic-related economic distortions are fading

- confidence has grown that inflation is on a sustainable path back to 2 percent.

- the unemployment rate began to rise over a year ago and is now at 4.3 percent—still low by historical standards, but almost a full percentage point above its level in early 2023 …(and) the downside risks to employment have increased.

- the upside risks to inflation have diminished.

- the time has come for policy to adjust. The direction of travel is clear, and the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks.

While the date of a first cut remains unknown, the direction is set. It’s now a matter of ‘when’.

Here in Australia, attention also turns to our Central Bank, the RBA, and how it might traverse this next period. For some time now, the RBA has been anything but circumspect. It has continually pointed to an elevated risk that the next move on interest rates here will be up, rather than down.

Armed with very few ready tools to deal with inflation, it is incumbent on the RBA to use language which clearly articulates that inflation is still lingering, and it won’t take its foot off the brake until it is back under control. But using Powell’s observations from Jackson Hole, where do we stand in Australia?

Pandemic-related economic distortions are fading

This remains relevant across a range of macroeconomic data. Inflation has declined materially from peak. The labour market, which was incredibly overheated in Australia, is now cooling. The supply constraints we knew so well as an island nation have normalised. The boom in house price growth nationally has eased, particularly in the major capitals of Sydney and Melbourne.

Against these considerations, we can see the worst of the pandemic-related economic distortions are behind us.

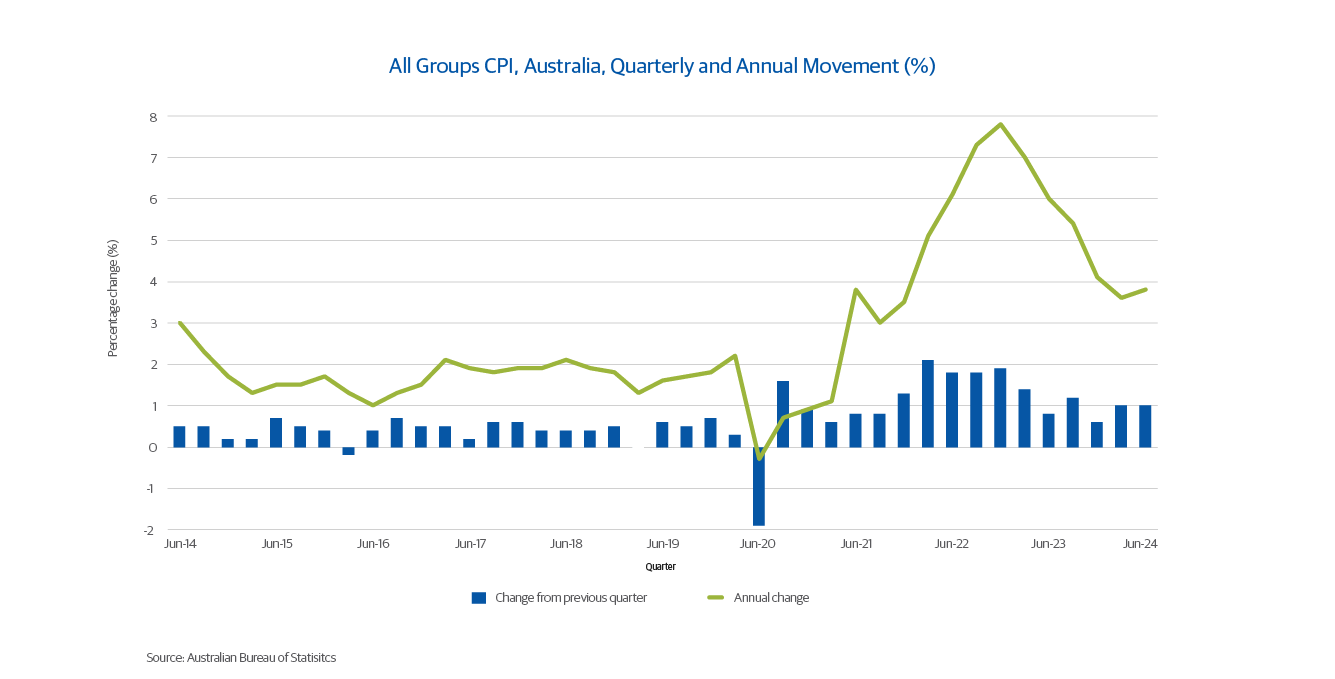

Inflation is on a sustainable path towards target

Or is it? This will remain a central consideration for the RBA. While the U.S Fed targets 2% inflation, it has been hovering at around 3% since June 2023. Although it has been sticky, it’s most recent observation in July 2024 pointed down to 2.9%. Here in Australia, our Reserve Bank targets a range of 2-3%. At the last reading for the June quarter, CPI in Australia sat at 3.8%. So it is declining from its earlier peak at 7.8%, but it still remains sticky, with just two consecutive quarters below 4%. It rose, and has since fallen, but with the last quarter’s reading being a ‘sideways’ movement, the RBA will want to wait, and wait, until the outcomes are where they want them, and sustainably so.

Employment figures are easing

Australia has a recent history of very low unemployment. The last decade , or indeed this century, has largely boasted full employment figures throughout. Post pandemic, unemployment fell lower again to all-time lows. This is a great outcome for individuals, but only serves to fuel inflation through additional consumption and wage pressures.

From a low of 3.5% in late 2022, the trend of unemployment is clearly set, and now sits at 4.2%. Each point upwards reflects an easing market, and takes future heat out of inflation figures. So here in Australia, the employment market is softening, and the downside risks to employment have increased.

The upside risks to inflation have diminished

Perhaps so in the U.S, however this is still not entirely the case here in Australia. According to the RBA’s August meeting minutes:

“Members assessed that the risk of inflation not returning to target within a reasonable timeframe had increased. This reflected the slow pace of disinflation over the preceding year, the staff’s judgement that the gap between aggregate demand and supply was larger than previously assessed, and the upward revision to the forecast for final demand.

Members discussed several developments that could suggest the risk of inflation not returning to the target range by late 2025 had risen materially. Underlying inflation was proving persistent and the central projection was now for inflation to return to target somewhat later than previously forecast.”

With such a definitive update coming so recently, even with some compelling data this is a narrative which will not turn quickly. So in Australia, the upside risks to inflation have not yet sufficiently diminished for the RBA to consider a rate cut.

The time has come for policy to adjust

Again, referencing the most recent communication from the RBA confirms their view that this is not the case. The closing comments from their August meeting confirmed based on the information available, it is unlikely that the cash rate will be reduced in the short term. Domestic banks are not waiting around. We observe a general softening of investment rates from Australian banks in recent months, as they move ahead of the Reserve Bank in anticipation of a cut in market rates. Further, and with a view to upside caution, that it is not possible to either rule in or out future changes in the cash rate target.

Don’t count your chickens…

Using the framework from Jerome Powell in the US, it looks like Australia is not quite ready to contemplate cuts. Remember, this is not a bad thing, per-se. It means we have a fully employed population, an active economy, and a population who are still consuming. The resilience of the Australian economy over the past five years has been remarkable, and the RBA will only begin cutting rates when those items are not at play.

So while market pricing here is leaning in favour of a first rate cut by the RBA in December 2024, this might yet be optimistic. With the RBA having famously gotten its 2020 call on interest rates so wrong, it will want to err on the side of caution on the other end of the cycle. It will want inflation to be crushed before allowing any respite in rates.

And we’re not there yet. We do see that rates have peaked, and we do see that inflation is retracing its steps towards target. Interest rate cuts will arrive in the fullness of time but calling for them to coincide with movements by the U.S Federal Reserve, or relying on them for speculative investment outcomes, is a case of counting your chickens before the eggs have hatched.

La Trobe Financial Asset Management Limited ACN 007 332 363 Australian Financial Services Licence No. 222213 is the responsible entity of the La Trobe Australian Credit Fund ARSN 088 178 321 and the La Trobe US Private Credit Fund ARSN 677 174 382.