Investing in Quality

If you have read any of La Trobe Financial’s updates over the past many years, you will have seen us talk about the fundamentals for success in investing: Quality assets, simple structures, experienced management. If you get these three items right – in any asset class – you are giving yourself the best chance of success.

In our last update, we discussed the rise of private capital markets. Globally, more and more companies are raising funds through private markets rather than by listing on stock exchanges. And with fewer stocks listing on exchanges, more and more investors are turning to private capital markets to place investments, too.

Within the world of private capital markets, a big driver of demand, and assets, is from the US middle market. Chances are, you will hear of more and more investments which comprise an allocation to companies in this sector.

But what is the US middle market? It is a collection of companies which are bigger than small businesses, but not the biggest global giants. It’s the heartbeat of the American economy. Companies with earnings between $25m per annum and $1 billion per annum. This sector is enormous, comprising over 200,000 companies. It currently accounts for approximately one third of all jobs in America, and is responsible for 40% of America’s total GDP.

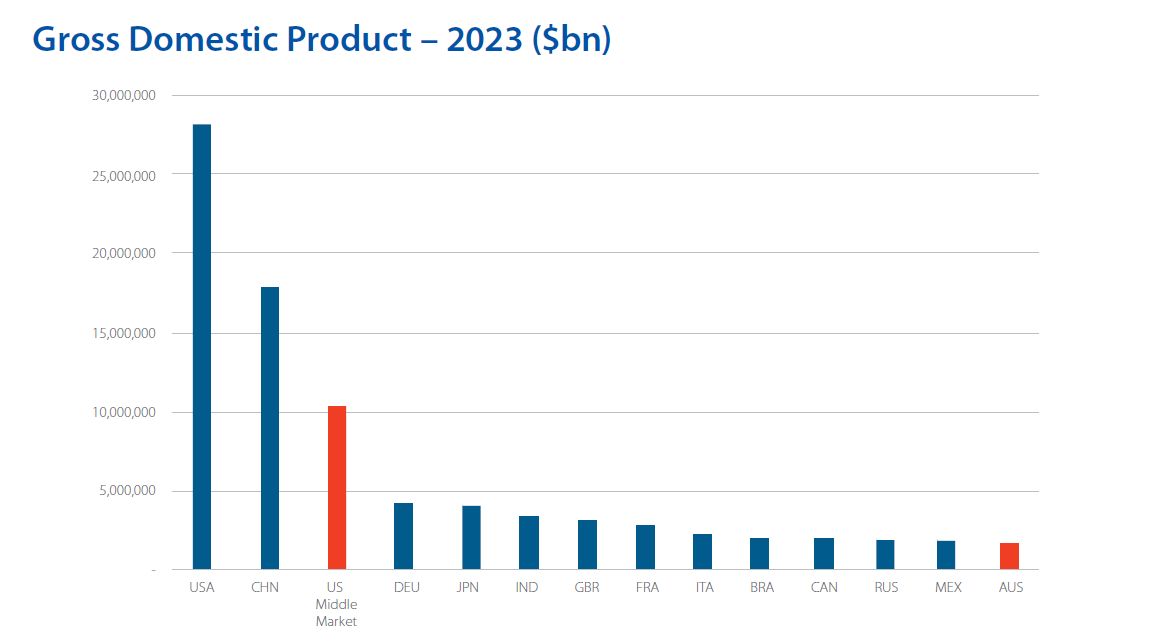

So, it’s large. In fact, if it were its own economy, the US middle market would be the third largest economy in the world. Far larger than Australia, which is a relative minnow as the 14th largest economy globally.

This sector has a tremendous set of tailwinds behind it. Possibly the only thing Republicans and Democrats agree on is the rebuild of middle America. Whether you want to ‘Make America Great Again’, or endorse the Inflation Reduction Act, the U.S. intends to bring manufacturing back on shore, build internal logistics, build data centres, build clean energy.

Middle market companies will be driving this. Middle market companies will be beneficiaries of this generational trend. And all the while, middle market companies are raising money from private markets to make it happen.

And that spells opportunity.

Capital raising for private markets used to be the domain of institutional and wholesale investors only. But with such a wall of money, a critical mass has been reached to allow retail investment strategies to be delivered from assets within the middle market. Infrastructure, real assets, and of course, private credit – lending to these companies as they grow to take advantage of the opportunities before them.

At La Trobe Financial, we have partnered with global investment giant Morgan Stanley to deliver a product which capitalises on this opportunity, in a very conservative way. Last December, we launched the La Trobe US Private Credit product, a diversified portfolio of directly originated, senior secured loans provided to companies operating in the US middle market. These are primarily first lien, floating rate loans to borrowers in non-cyclical industries, with the companies owned by large private equity firms.

This narrow focus on high quality assets, in an easy to understand structure, with a high-quality partner in Morgan Stanley aligns with our view on the best way to achieve success. Initially available to wholesale investors#, we will shortly be making the product available for retail investors with the launch of our Product Disclosure Statement in June 2024+.

We’re excited by the opportunity to deliver additional product opportunity to our investors with the attributes you are already familiar with from La Trobe Financial: low volatility returns and a monthly income experience.

If you would like to learn more, please do not hesitate to contact our friendly Asset Management team on 1800 818 818.

Monthly Investor Webinar

Each month, La Trobe Financial produces a series of short videos. Watch now to stay up to date with our business, our portfolios and what we’re seeing in the economy. This month, we provide an update on our portfolio performance, and share our current thinking on the property market and economy.

Corporate & Portfolio Update: Chris Paton, Chief Investment Officer

After another strong start to the year, the performance of our existing strategies continues to deliver for investors. We are excited to be building on our existing strategies with the launch of La Trobe Global Asset Management, and the first of a new range of investment products – the La Trobe US Private Credit Fund. The new product launches to retail investors shortly+, offering:

- A diversified portfolio of high-quality assets from the US middle market.

- A partnership with global investment giant Morgan Stanley.

- A clear, transparent, and easy to understand investment structure.

Economic Update: Michael Watson, Head of Distribution

As our economy continues down its narrow path of avoiding recession, controlling inflation, maintaining full employment, but while not seeing a fallout in house prices, the federal government has handed down its budget for the financial year ahead. The budget is serving paradoxical issues of growing an economy and cooling inflation, no easy task:

- Long term challenges of increased government spending are not addressed in any meaningful way, nor the challenge of low productivity growth.

- Headline surplus of $9.3billion is thanks to a revenue windfall rather than savings; and,

- This budget does not meaningfully address inflation or bring it under control faster.

Credit & Property Market Update – Lilian Chin, Head of Client Partnerships

With residential property price growth continuing month-on-month across Australia, those calling for a sharp downturn in prices are playing a very long waiting game. Any deep cyclical downturn in prices is being protected by:

- Most households managing to meet the challenging economic conditions.

- The ‘fixed rate cliff’ moment having passed, without a noticeable uplift in arrears or distressed selling.

- Auction clearance rates remaining high, characterising a market of demand exceeding supply.

# The offer to apply for Class A Units in the La Trobe US Private Credit Trust is open to wholesale investors only. Investors applying to invest less than $500,000 will need to produce an accountant’s certificate to support their wholesale status. For more information, please refer to the Application Form (Annexure 2 to the Information Memorandum).

+ A description of the Target Market for La Trobe Financial’s US Private Credit Fund – Class B Units can be located on our website. The PDS will be available on or around 3 June 2024.

La Trobe Financial Asset Management Limited ACN 007 332 363 Australian Financial Services Licence 222213 is the responsible entity of the La Trobe Australian Credit Fund ARSN 088 178 321 and the La Trobe US Private Credit Fund ARSN 677 174 382. It is important for you to consider the relevant Product Disclosure Statement (PDS) for a fund in deciding whether to invest, or to continue to invest, in a fund. You can read the PDS and the Target Market Determinations for the La Trobe Australian Credit Fund on our website. The PDS for the US Private Credit Fund will be available on our website on or around 3 June 2024

Past performance is not a reliable indicator of future performance.

La Trobe Financial Services Pty Limited ACN 006 479 527 Australian Credit Licence 392385.

To the extent that any statement in this email constitutes financial product advice, that advice is general advice only and has been prepared without considering your objectives, financial situation or needs. You should, before deciding to acquire or to continue to hold an interest in the La Trobe Australian Credit Fund, consider the appropriateness of the advice having regard to your objectives, financial situation or needs and obtain and consider the Product Disclosure Statement for the Fund.

© Copyright 2024 La Trobe Financial Services Pty Limited ACN 006 479 527. All rights reserved. No portion of this may be reproduced, copied, or in any way reused without written permission from La Trobe Financial.