Product focus – 12 Month Term Account

Australia’s flagship real estate private credit offering

The 12 Month Term Account has been in operation since 2002 and is Australia’s most awarded Private Credit strategy. It has an impeccable track record for investors, headlined by 100% capital return, flawless liquidity and an income profile that has delivered month after month, without exception. This is notable across a period that includes the Global Financial Crisis, COVID-19 and Silicon Valley Bank episodes and interest rate cycles of all descriptions. *

Each month, we publish publicly thousands of datapoints across all of our Australian Real Estate Private Credit offerings, giving you a month-on-month deep-dive on portfolio composition, asset quality, diversification and borrower performance.

Click here for thousands of datapoints across our Australian Real Estate Strategies.

What’s under the hood

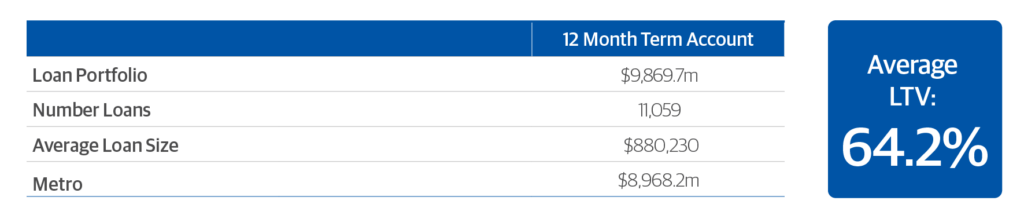

With almost $10bn in assets under management at 28 February 2025, the 12 Month Term Account is comprised of 11,059 individual loan assets. With an average loan size of just $880,230, this portfolio is incredibly granular. We build it this way to ensure maximum diversification – the performance of any one loan won’t impact the investment outcome for investors.

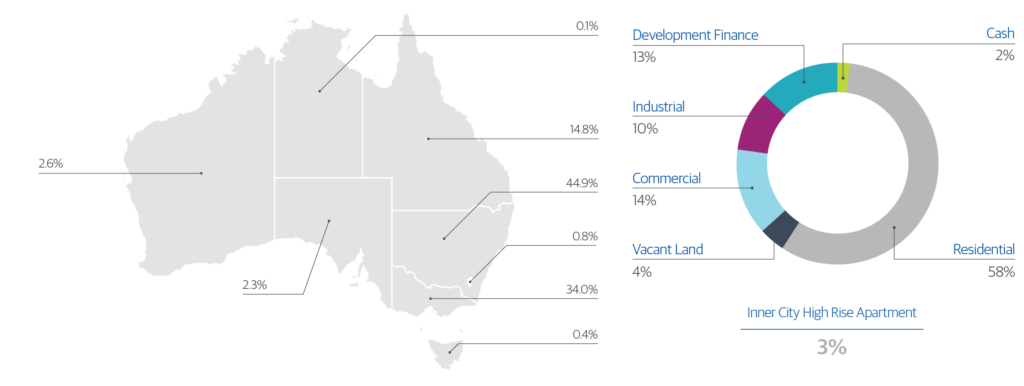

Geographically our assets follow the gravity centres of Australia’s population, ensuring they remain within the broadest and deepest markets. Our largest exposures are to residential loans, with strategic exposure into commercial, light industrial, vacant land and development finance. We also avoid over-exposures to more cyclical markets – like inner city high rise apartments.

Wanting to know about the health of the portfolio? We provide granular data on that too, providing arrears by number, dollar and portfolio percentage.

Product Focus – La Trobe US Private Credit Fund

Defensive exposure to the world’s largest corporate private credit market

Launched in December 2023, the La Trobe US Private Credit Fund provides investors with a defensive exposure to U.S. mid-market private credit. The product has delivered on its objective of providing a diversified, low-volatility income stream for investors since inception.

Our commitment to total transparency extends to our US Private Credit Fund, where we publish both a monthly report and quarterly snapshot & metrics, shining a light on portfolio composition, asset characteristics, diversification and borrower performance.

Click here for our most recent US Private Credit quarterly snapshot & metrics.

What’s under the hood

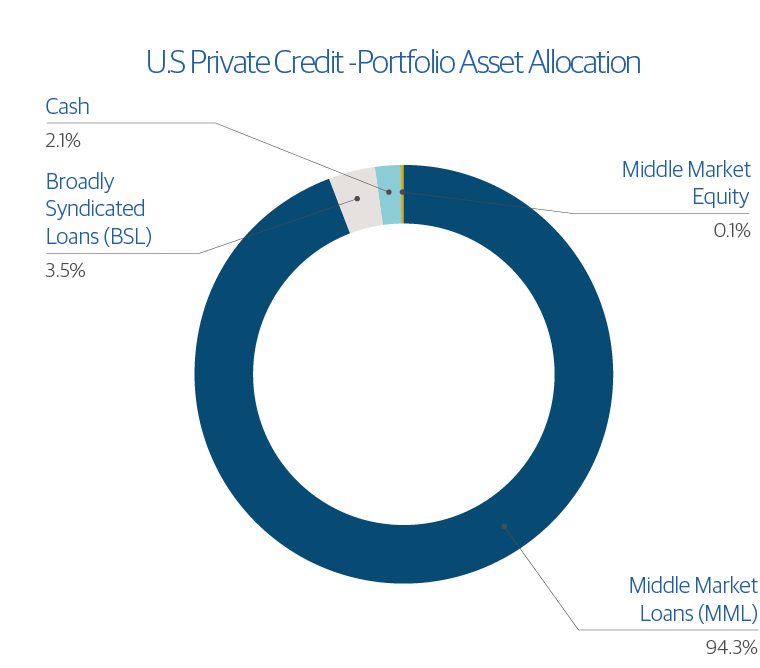

The La Trobe US Private Credit Fund is a ‘pure-play’ strategy: a portfolio of directly originated, senior secured first lien sponsor-backed term loans to middle market companies. With a small holding of cash and liquid assets, this portfolio is comprised of the kinds of asset you expect to see in the portfolio. What’s on the label is what’s ‘in the tin.’

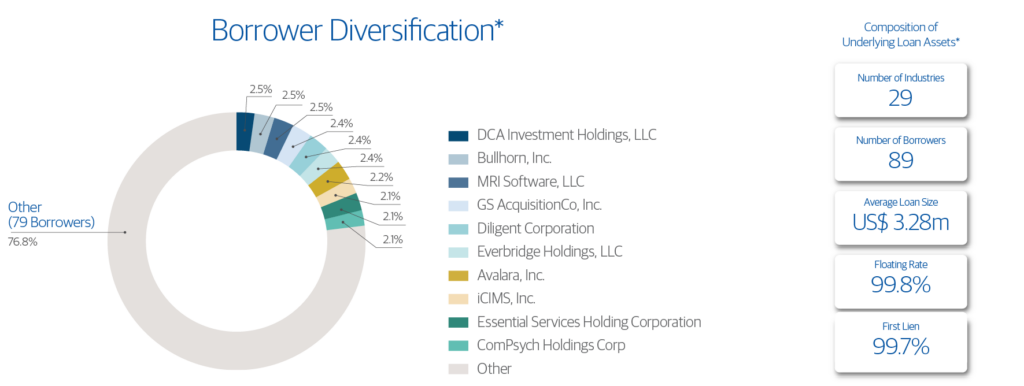

Dig a little deeper and you will see that this is a very granular portfolio: 89 individual loan assets with an average investment size of USD3.28m. The largest exposure within our portfolio is just 2.5%, ensuring that no one investment can unduly impact the performance of our strategy.

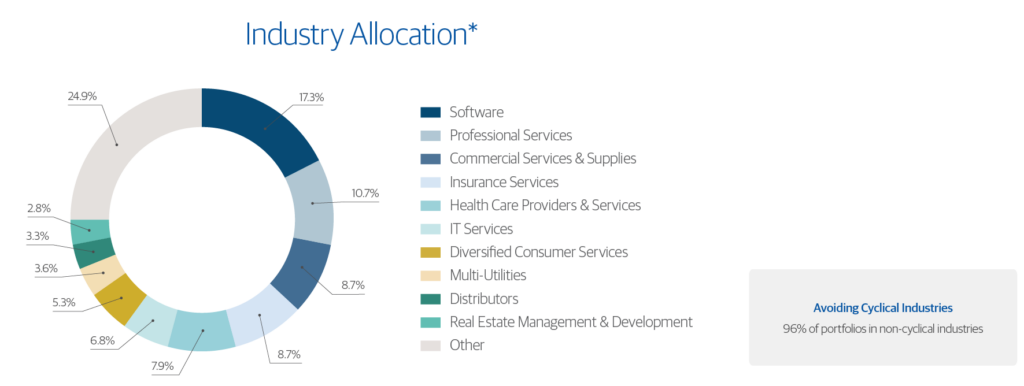

You will also identify that we focus on providing loans to borrowers operating in non-cyclical industries as they generate strong and stable free-cash flows in good and in bad economies.

Wanting to know how each of the loans in our portfolio are performing? We shine a light on that too, with the performance of every loan reported quarterly, complete with quarter-on-quarter commentary on any underperforming loan in the portfolio.

At La Trobe Financial, we are dedicated to providing our investors with robust and transparent investment portfolios. There should be no surprises.

La Trobe Financial Asset Management Limited ACN 007 332 363 Australian Financial Services Licence No. 222213 is the responsible entity of the La Trobe Australian Credit Fund ARSN 088 178 321 and the La Trobe US Private Credit Fund ARSN 677 174 382. It is important that you consider the relevant Product Disclosure Statement (PDS) before deciding whether to invest or continue to invest in the fund. The PDSs and Target Market Determinations are available on our website.

*Past Performance is not a reliable indicator of future performance.